Having bad credit is something that many people face. Not only does it limit your ability to make purchases, but it also can affect your entire life in different ways. Striving to improve your credit is something that everyone should be doing. Unless you have perfect credit, you need to be actively working on it. Below are some tips that will help you improve your credit score and forget about the bad credit, which will make your life much easier.

Track Your Spending

Nothing is worse for your credit score than uncontrolled spending. If you don’t know how much you are spending, you will never improve your bad credit. To boost your credit score, you will need to track every purchase. That will allow you to cut down on spending money on things you don’t need.

Set Up a Budget

Don’t have a budget in place? If not, you’re not alone, but you need to set up one as soon as possible. Setting up a budget will allow you to know how much money is coming in and how much is going out. This will allow you to prioritize your spending, which will help you decide which loans should be paid down first. Having a budget in place will also allow you to put some money aside for a rainy day.

Create a Plan to Pay Off Debt

Once you have a budget in place, you will be able to create a plan to pay off debt. A good way to improve bad credit is by paying off the smallest debt you have first. Then the money you would be spending on that that payment can be applied to your next smallest debt. Keep doing this until all your debts have been reduced or eliminated.

Pay More Than the Minimum Payment

Instead of paying just the minimums on your loans and credit cards, pay a little more each month. This will reduce your debt which in turn will improve your credit score. The more you can pay each month, the better. Making the minimum payment will take you years to pay off your debts. You will also pay more in high-interest charges. So, when possible, pay a little more on your accounts.

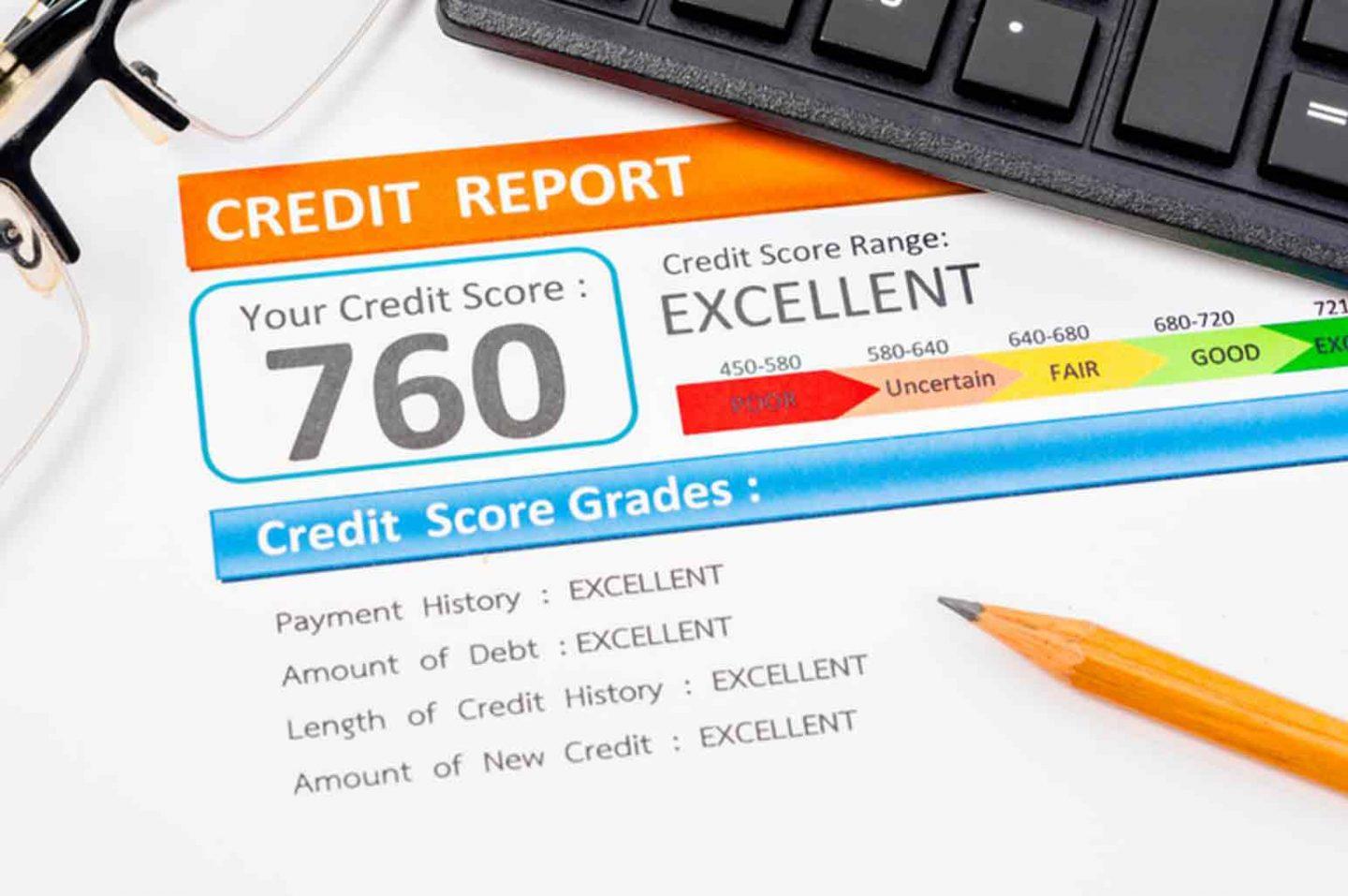

Raise Your Credit Score

Having bad credit isn’t the end of the world, but it can severely limit your financial ability. Raising your credit score by using responsible spending and lending practices, can help you leave your bad credit behind. Always make sure you make timely payments on your loans and keep your account levels below 30% of your total spending limits.

Stop Borrowing Money

If your credit is bad, the first step you should take to improve it is to stop borrowing money. You can’t lend your way out of debt, and adding additional debt only makes things worse. Instead, limit your spending so that you don’t have to borrow money just to make ends meet. The less you have to borrow, the better your credit score will be.

Consider Consolidating Your Debt

For those that have several different loans and credit card debt, consolidation may be right for you. With a debt consolidation loan, you will be able to pay off all your accounts, making your debt easier to manage. This will help prevent missed payments which can hurt your credit.

Work With a Credit Counselor

One of the best ways to rid yourself of bad credit is by working with a professional credit counselor. A credit counselor can help guide you in the right direction and give you some tips to improve your credit score. Depending on your level of income, you may qualify for free credit counseling. There are many non-profit credit counseling services around the country that you can utilize to improve your credit score.

Take Out a Home Equity Loan

Do you have equity built up in your home? If you’re drowning in debt, a good way to pay it off is with a home equity loan. With a home equity loan, you will get a better interest rate and become debt-free much faster. This will help you get rid of bad credit much faster than slowly paying down your debt.

Put Away Those Credit Cards

When you carry credit cards in your wallet or purse, you may be tempted to use them. Instead of carrying them around, put them in a safe place at home. This will help you limit the amount of debt you incur and allow you to pay off those high-interest credit cards.

These are a few tips that can help you improve your bad credit. Remember, poor credit is something that you can actively work on. If you follow these tips, you will be out of debt in no time at all.